30+ Bi monthly mortgage calculator

Bi-Weekly Mortgage Payment Calculator. Following is a list of options that the biweekly mortgage calculator includes some of them are optional fields.

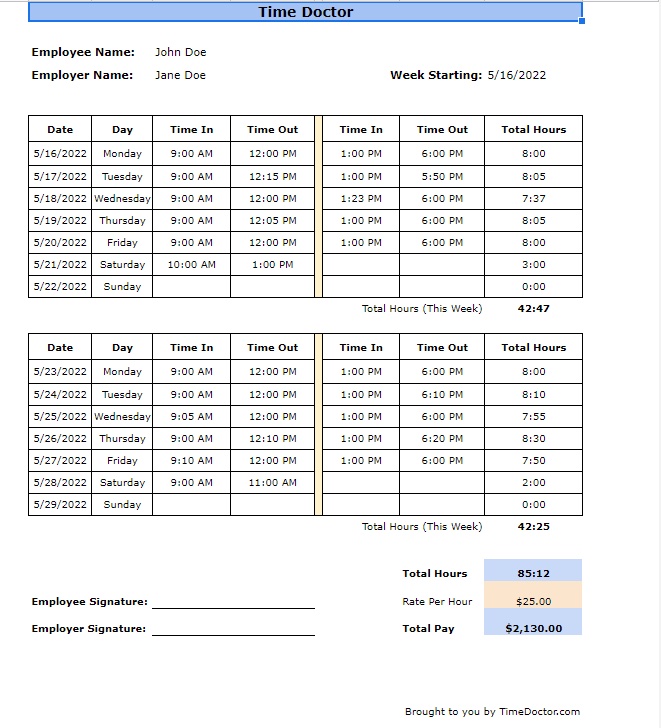

Free Biweekly Timesheet Template Excel Pdf Word

Those affect your monthly mortgage payment so the mortgage income calculator allows you to take those into account as well.

. For example a 30-year. If you would like to compare fixed rates against hybrid ARM rates which reset at various introductory periods you can use the loan type menu to select rates on. ICB Solutions a division of Neighbors Bank.

How much money could you save. Check with your bank or lender to ensure that it will accept bi-weekly payments instead of monthly. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. Shop around for the best mortgage rate you can find and consider using a mortgage broker to negotiate on your behalf.

Not affiliated or endorsed by any govt. Over a year this means that youll be making 26 bi-weekly mortgage payments to account for there being 52 weeks in a year. Mortgage APR Calculator.

Head of households can deduct 18800 whie married joint filers can deduct 25100. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. All you have to do is enter the value of your annual income and the length of your loan on the mortgage qualifying calculator and it will display the monthly payment you should expect.

Helps you pay off your loan faster and reduce the total interest you will pay on your mortgage. Community State Bank 802 E Albion St. Adjustable Rate Mortgage Calculator.

Refinance Today to Lock-in Redmonds Low 30-Year Mortgage. To the monthly mortgage and turbo charge your interest savings. Press spacebar to.

The most common terms for mortgages are 15 years and 30 years. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired.

See how you can save money on interest in the long term and figure out what the best mortgage option is for you. This bi-weekly mortgage calculator has more features than most - includes extra payment and printable amortization table to plan your interest savings. It will also save you thousands of dollars over the life of your mortgage.

Mortgage loan basics Basic concepts and legal regulation. A payment is applied after there are sufficient funds to make a complete payment resulting in 13 payments being made in a year. By sending 1300 to your lender monthly youll overpay your mortgage by.

Are You Itemizing Your Income Tax Deductions. Extra Payments In The Middle of The Loan Term. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing. The second monthly payment budget calculator shows how expensive of a motorcycle you can buy. Then enter the loan term which defaults to 30 years.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Get a better mortgage rate. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the.

Use our free mortgage calculator to estimate your monthly mortgage payments. Bi-Weekly Payment Calculator For an Existing Mortgage. Our calculator includes amoritization tables bi-weekly savings.

The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options. Payment Frequency - Monthly Bi-weekly not only can you calculate bi-weekly but you.

Check out the webs best free mortgage calculator to save money on your home loan today. A lower mortgage rate will result in lower monthly payments increasing how much you can afford. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions.

Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes. Make an Extra Mortgage Payment Every Year. To help you see current market conditions and find a local lender current current Redmond motorcycle loan rates and personal loan rates personal loan rates are published below the calculator.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. Biweekly Mortgage Calculator. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

A draft in the amount of half of your monthly payment is made every 2 weeks and held in escrow. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and. This calculator figures monthly motorcycle loan payments.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. How to Use the Mortgage Calculator. By default 250000 30-yr fixed-rate loans are displayed in the table below.

A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. Lock-in Redmonds Low 30-Year Mortgage Rates Today. The most common mortgage terms are 15 years and 30 years.

About the bi-weekly mortgage payment program and whether its an effective way to own your home faster. The biweekly payment calculator has the option to include PMI property tax and home insurance which will make the interest savings even bigger. For example with a 30-year.

Paying bi-weekly means paying half the monthly amount every two weeks. While two bi-weekly payments will be made for 28 days a month has either 30 days or 31 days except for February. Determining the monthly mortgage payment you qualify for is similar to calculating the maximum mortgage loan you can afford.

Filters enable you to change the loan amount duration or loan type. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Account for interest rates and break down payments in an easy to use amortization schedule. The following table shows current Redmond 30-year mortgage rates as that is the most popular choice by home buyers across the United States. That means 26 half-payments or 13 full payments which is one extra payment per year.

In 2021 the standard deduction for single filers married filing separately is 12550. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. For simplicitys sake use the same 200000 loan amount and 30-year.

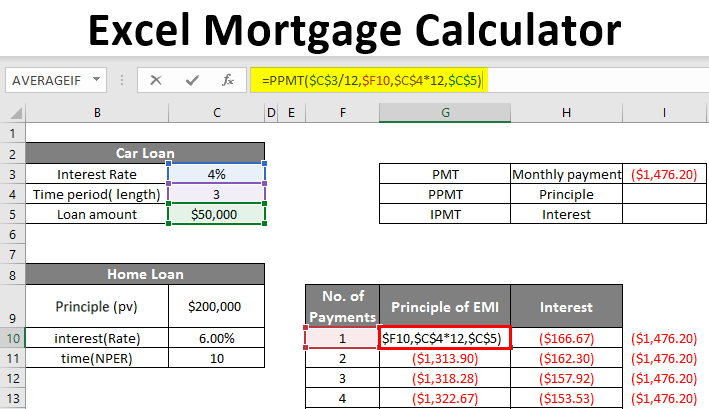

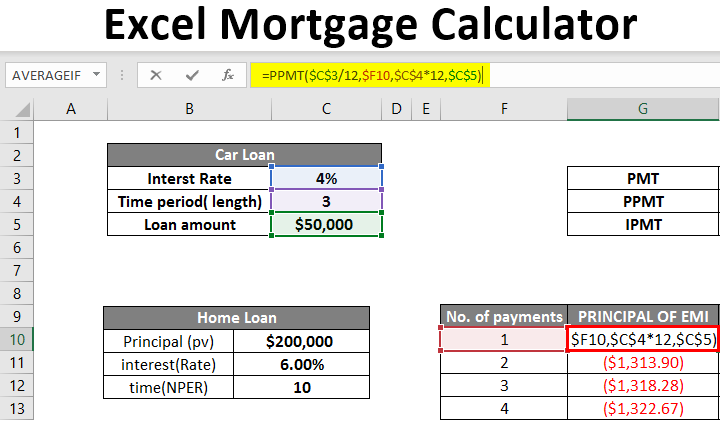

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

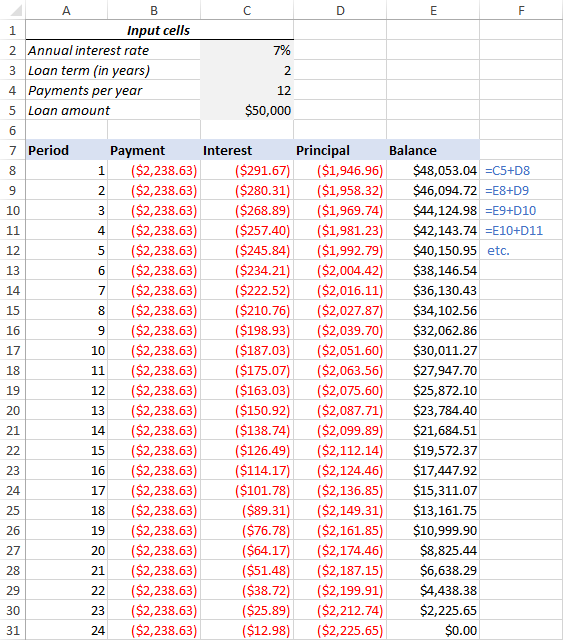

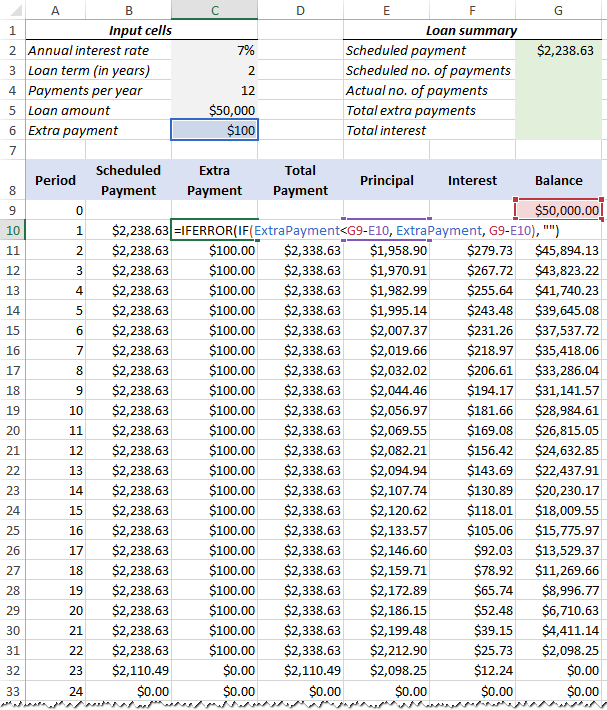

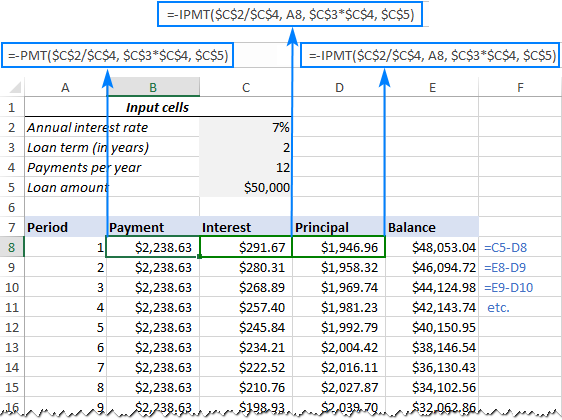

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Net 30 And Other Invoice Payment Terms Invoiceberry Blog

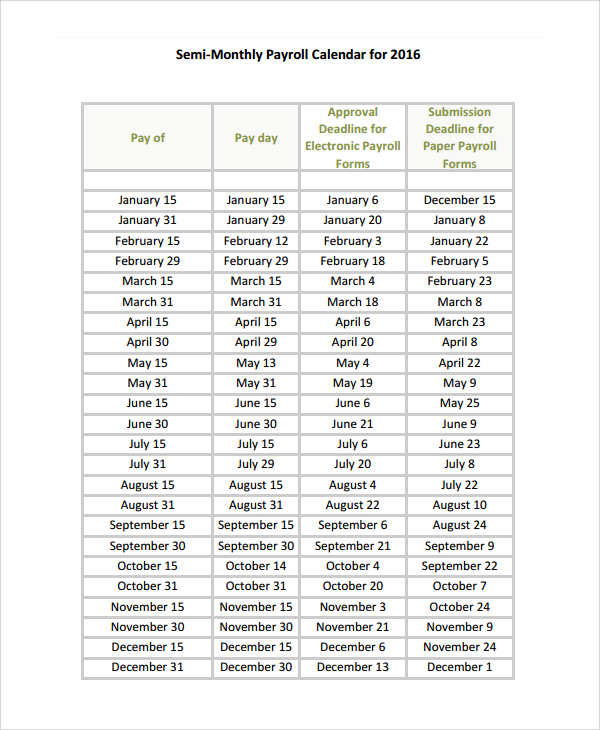

Free 9 Sample Payroll Calendar Templates In Pdf Excel

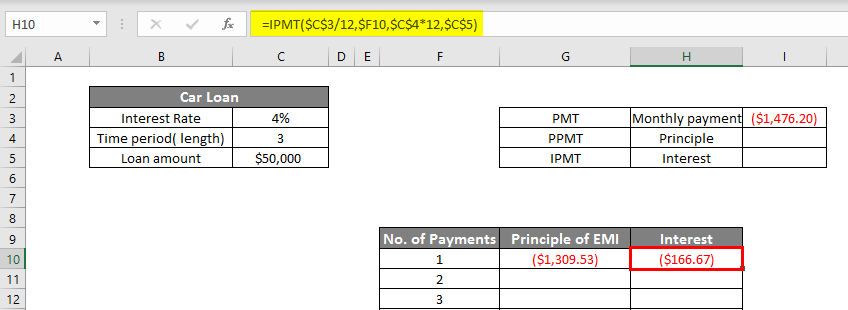

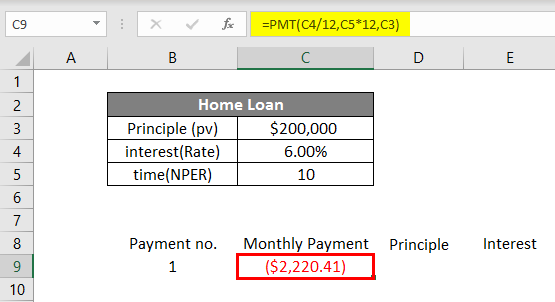

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Biweekly Savings Challenges Saving 1 000 5 000 10 000 This Year Saving Money Budget Money Saving Strategies Best Money Saving Tips

How To Create A Biweekly Budget In 5 Simple Steps Clever Girl Finance

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

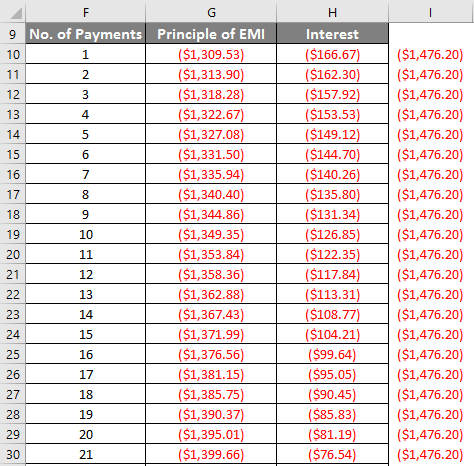

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

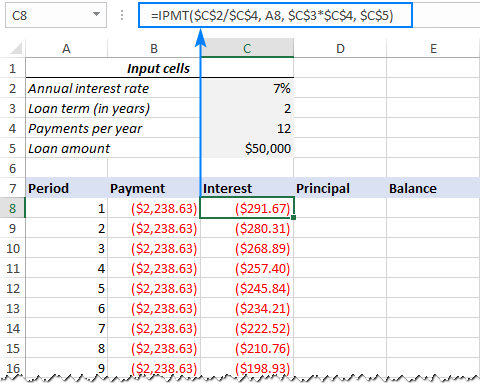

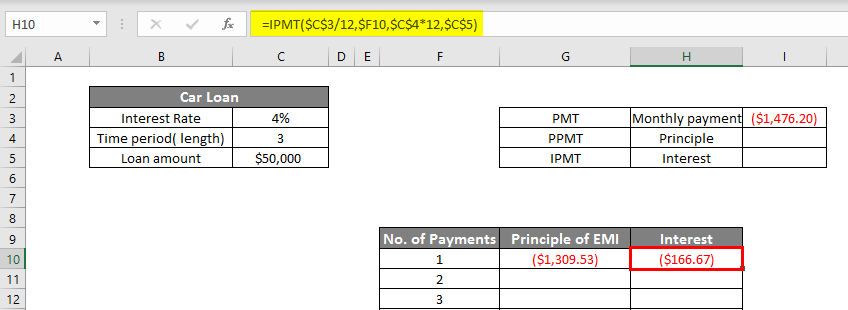

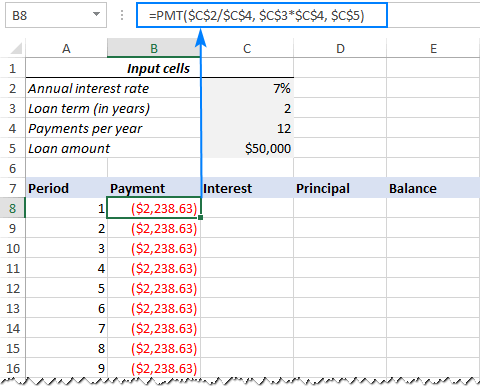

Excel Pmt Function With Formula Examples

Excel Ppmt Function With Formula Examples

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed